The Intelligent Investor book PDF free download

Over the years, market developments have proven the wisdom of Graham's strategies. While preserving the integrity of Graham's original text, this revised edition includes updated commentary by noted financial journalist Jason Zweig, whose perspective incorporates the realities of today's market, draws parallels between Graham's examples and today's financial headlines, and gives readers a more thorough understanding of how to apply Graham's principles.

Key takeaways Summary Book reviews Author bio

What you can learn from The Intelligent Investor

Graham began teaching value investing as an investment approach at Columbia Business School with David Dodd in 1928. In 1949, Graham and Dodd published The Intelligent Investor. These are some of the key concepts in the book.

Margin of safety

Graham also advocated for an investment approach that offered the investor a margin of safety, or room for human error. There are several ways to accomplish this, but buying undervalued or unpopular stocks is the most important. Investor irrationality, inability to predict the future, and fluctuations in the stock market can offer investors a margin of safety. Investors can also gain a margin of safety by diversifying their portfolios and buying stocks in companies with high dividend yields and low leverage ratios. This margin of safety is intended to reduce the investor's losses in the event of a company bankruptcy.

Dividend stocks

Many of Graham's investment principles are timeless - they are as relevant today as they were in his time. Graham criticized companies for their dark and erratic financial reporting methods, making it difficult for investors to get an accurate picture of a company's health. Later, Graham wrote a book on interpreting financial statements, from balance sheets and income and expense accounts to financial metrics. Graham also advocated for companies to pay dividends to their shareholders instead of keeping all of their earnings as retained earnings.

Mr. market

Graham's favorite allegory was that of Mr. Market. This imaginary person, "Mr. Market", shows up at the shareholder's office every day and offers to buy or sell his stock at a different price. Sometimes the suggested prices make sense, but sometimes the suggested prices are wrong given current economic realities.

Individual investors have the option of accepting or rejecting Mr. Market's offers on any day, giving them an advantage over those who feel compelled to invest, regardless of the current valuation of the securities. It is better for an investor to focus on the actual performance of their companies and the dividends received, rather than looking at the shifting sentiments of Mr. Market as a determining factor in the value of the shares. An investor is neither right nor wrong when others share the same views as him; only facts and analysis can get them right. 2

When an investor buys a stock at a price that is below its intrinsic value, he is essentially buying it at a discount. Once the shares are trading at their intrinsic value, sell them.

Value investment

Investment in value is the derivation of the intrinsic value of an ordinary share regardless of its market price. Analysis of a company's assets, earnings, and dividend payments can help determine the intrinsic value of a stock, which can then be compared to its market price. If the intrinsic value is higher than the market value, in other words the stock is undervalued in the market, the investor must buy and hold until a mean reversion occurs. The mean reversion theory states that the market price and the domestic price converge over time. At that point, the price of the stock will reflect its true value.

The Benjamin Graham formula

Typically, Graham only bought stocks that traded with two-thirds of his net worth to establish his margin of safety. Equity is another value investing technique developed by Graham in which a company is valued solely on the basis of its net working capital.

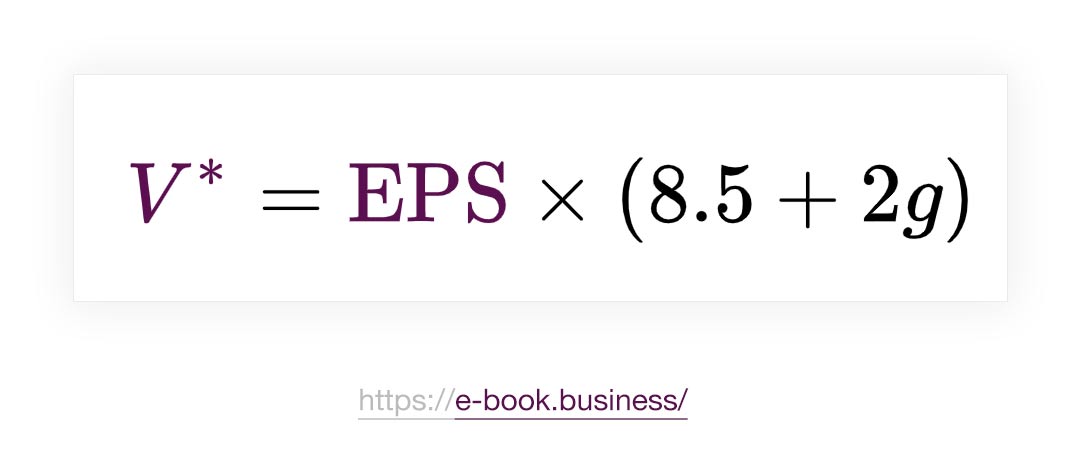

Benjamin Graham's original formula for determining the intrinsic value of a stock was:

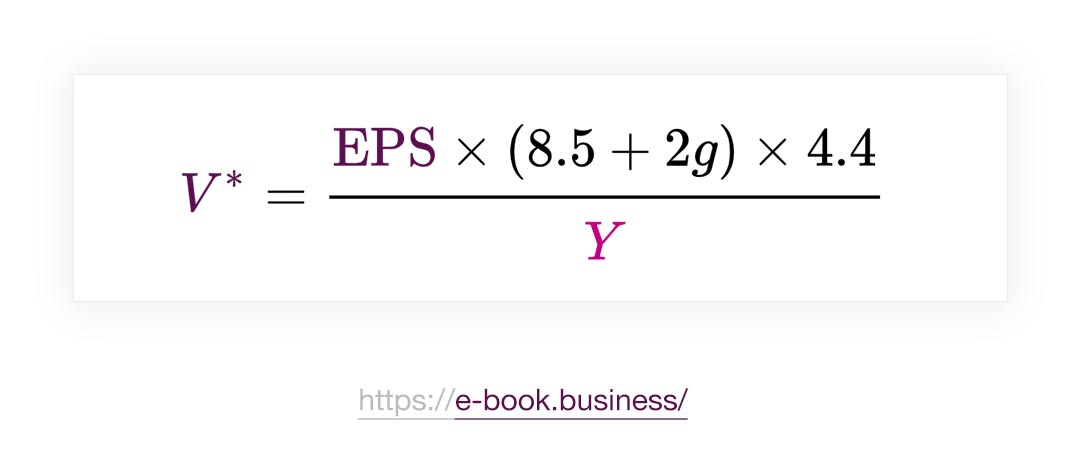

Later, Graham revised his formula to account for both a 4.4% risk-free rate (the average yield on high-quality corporate bonds in 1962) and the current yield on AAA corporate bonds, represented by the letter Y:

The Intelligent Investor book reviews

The Intelligent Investor review by Tony Bellavia

A great book for all those who are directly or indirectly interested in finance and investing.

This book will give you the theoretical bases to invest smartly and safely.

Benjamin Graham makes a point of making the distinction between investment and speculation and why wanting to beat the markets is illusory, each chapter is always illustrated with examples and concrete studies.

The Intelligent Investor review by Alexandru-Thomas Narita

An impressive book from all points of view. I do not recommend it to those who have not studied investments and do not have a basis for the economic terms used, because this book does not always explain the terms used. A book that offers you a lot to learn, especially through historical fragments of the stock exchange.

The Intelligent Investor review by Andrè Maia

A great book on investing, but a very difficult book for beginners. I had to take several breaks to understand some concepts and then have a minimum of understanding. In addition to the concepts, the book is also old, which makes it a little more difficult for non-experts to understand.

It will definitely be a book to revisit in the future with more experience in investment concepts.

The Intelligent Investor PDF review by Dr. Tobias Christian Fischer

A very good book to develop your knowledge of investing in action! I have invested in some stocks myself and find the tips very good. In this way I can further expand my knowledge in this direction.

The Intelligent Investor review by Arkadii

A must read by anyone who spends their money on something other than deposits. Despite many years, it is still very relevant. After each chapter, very good comments by a contemporary author.

Intelligent Investor PDF review by Lars-Helge Netland

Classic with many good points that made me radically change the investment philosophy. Then we will see in a few years how these gold grains work in practice for an amateur investor...

The Intelligent Investor eBook review by Kacper

A great title for people who are serious about investing. Graham clearly and emphatically describes the ways to determine the real value of shares, draws attention to common mistakes when investing, and strongly emphasizes the difference between a speculator and an investor.

Nevertheless, I have to make two points. First, The Intelligent Investor is a book that was last published as an original in the 1970s, so it's better to look for more recent editions updated with commentary - such as my edition, supplemented by Zweig. Secondly, the translation I came across unfortunately made it difficult to read, often losing the meaning of the sentence - sometimes things that were directly proportional were described as inversely proportional, sometimes the grammar did not stick together, and there was also a small confusion between stocks and bonds - and only from the context you can could have guessed what was going on. If anyone would like to read this title, it is definitely worth looking for the original in English.

The third objection to The Intelligent Investor book is the high entry threshold. I think after reading Iwucia's "The Financial Fortress", I can say that I understood most of this book, but not all of it. Graham often uses (at least in translation) the jargon of stock market analysts, and often uses financial instruments that may have gone out of circulation until our times. Only Zweig's comments explain something.

With these three things in mind, I can move on. Benjamin Graham gave a lot of tips and advice on how to find yourself in the crazy world of investment in "The Intelligent Investor". He outlined tons of techniques, suggestions, and rules that must be followed - not so much to invest effectively, but not to waste money stupidly. Another thing is not assuming that this book is going to make anyone a millionaire. Not. This book is intended only to make the average investor or stock market trader a person who at least knows what he is doing.

As such, Graham's tutorial works brilliantly. After reading it, I can say that my previous adventures with investing did not have much to do with reality.

If there's one thing I will remember about this book for a long time is that investing is like any other business. Business is based on calculation, experience and trust. Nobody would leave their business (or investment) in the hands of a randomly met person. Nobody would put a lot of money into a machine or production line that has no chance of paying back. Nobody will push themselves into innovative solutions without having a clue about a given industry.

And somehow, as Graham realizes, when investing in the stock market, people do the above-mentioned things without thinking twice.

The Intelligent Investor review by Jhonatan Ramos

The Intelligent Investor book aims to guide the reader in adopting an investment policy. For this, it teaches the differences between investment and speculation, divides the types of investors into defensive investor (passive) and enterprising investor (active), discussing appropriate strategies for each of them, teaches how to deal with market fluctuations through the method of average cost in dollars with periodic changes in the ratio between bonds and shares (from 50-50% to 25%-75, depending on the case), and defines the concept of safety margin, presenting it as the secret of sensible investment.

This is the golden book for conservative investors, those who want to multiply their assets with the least possible risk of losing money. Despite exposing strategies for both types of investors, Graham even wonders, at a certain point in the text, about the validity of being an entrepreneurial investor in his time, even though he leaves open the possibility that it would be advantageous to do so in the future. . One of the secrets of the success of this work is placing the investor in the center of attention. He himself is his greatest enemy, not the fluctuations of the market, his personality and reactions being, as well as his time and effort devoted to study, much more important to the success of his investments than anything else.

Intelligent Investor ePub review by Marius Heje Mæhle

The most important book you need to read if you are going to invest. The idsg principles are much the same, although much has changed since Graham's time.

The Intelligent Investor review by Lubos Elexa

Excellent reading, a practical look, occasionally repetitive parts ... I keep coming back to the content and even though many blame Buffet for his behavior in times of crisis, unlike many others he is an investor rather than just a "speculator".

Benjamin Graham bio

Benjamin Graham (May 8, 1894 - September 21, 1976) was an American economist and professional investor. Graham is considered to be the first advocate of value investing, the investment approach he taught at Columbia Business School in 1928 and then refined with David Dodd in various editions of their famous book, Safety Analysis. Value Investing students include Jean-Marie Eveillard, Warren Buffett, William J. Ruane, Irving Kahn, Hani M. Anklis, and Walter J. Schloss. Buffett, who credits Graham for cementing him with a solid framework of intellectual investment, described him as the second most influential person in his life after his father. In fact, Graham had such an impact on his students that two of them, Buffett and Kahn, named their sons after him, Howard Graham Buffett and Thomas Graham Kahn.

One of Graham's key contributions was an indication of the irrationality and groupthink that often plagued the stock market. Thus, according to Graham, investors should always seek to capitalize on the vagaries of the stock market, not participate in it. His principles of safe and successful investing continue to influence investors today.

After graduating from Columbia University in 1914, Graham went to work on Wall Street. During his 15-year career, he was able to grow a large personal nest egg. Unfortunately, Graham, like many others, lost most of his money in the 1929 stock market crash and the Great Depression that followed.

This experience taught Graham a lesson in minimizing the downside risk by investing in companies that traded well below their liquidation values. Simply put, his goal was to buy $ 0.50 worth of assets. To do this, he used market psychology, using market fears to his advantage. These ideals inspired him to write Security Analysis, which was published in 1934 with co-author David Dodd. The book was written in the early 1930s, when both authors were professors at Columbia University Business School. The book describes Graham's methods for analyzing securities.

The Intelligent Investor FAQ

What does The Intelligent Investor teach you?

The smart investor is widely considered to be the authoritative text for value investing. Graham said investors should analyze a company's financial reports and operations but ignore the noise of the market. Investor whims, greed and fear, are what create this noise and fuel daily market sentiment.

Most importantly, investors should look for discrepancies between price and value when a stock's market price is below its intrinsic value. When these opportunities are recognized, investors need to make a purchase. As soon as the market price and intrinsic value are aligned, investors should sell.

The wise investor also advises investors to keep a portfolio of 50% stocks and 50% bonds or cash to be the stumbling blocks of intraday trading to take advantage of market fluctuations and market volatility so as not to simply buy stocks when they are in vogue right now and are looking for ways that companies can manipulate their accounting policies to add value to their EPS.

Is The Intelligent Investor Good for Beginners?

The Intelligent Investor is a great book for beginners, especially since it has been constantly updated and revised since it was originally published in 1949. It is considered a must have for new investors trying to discover the basics of how the market works. The book was written with long-term investors in mind. For those interested in something more glamorous and possibly more modern, this book may not hit the mark. It offers a wealth of common sense advice rather than how to make short term profits through day trading or other common trading strategies.

Is The Intelligent Investor out of date?

Although this book is over 70 years old, it is still up to date. The advice to buy with a margin of safety is as strong today as it was when Graham taught his philosophy. Investors should do their homework (research, research, research) and once they identify the value of a company, buy it at a price that will give them a buffer in case prices fall.

Graham's advice that investors should always be prepared for volatility also remains highly relevant.

What Kind of Book is The Intelligent Investor?

The Intelligent Investor, first published in 1949, is a widely acclaimed book on value investing. Investing in value aims to protect investors from significant harm and teaches them to develop long-term strategies. The Smart Investor is a practical book; teaches readers to apply Graham's principles.

How do I become an Intelligent Investor?

Benjamin Graham challenges everyone who wants to be successful as an investor to the two principles of valuation and patience. To determine the true worth of a company, you need to be prepared for the research. Then when you have bought shares in a company you should be willing to wait for the market to recognize that it is undervalued and mark its price. If you only buy from companies that are trading below their true or intrinsic value, the investor has a cushion even if a company suffers. This is known as the margin of safety and is key to the success of the investment.

Source: https://e-book.business/the-intelligent-investor/

Posted by: ikesteitze021657.blogspot.com

0 Komentar